FHFA Refinancing Fee-Delayed

Originally on August 12th, the FHFA (Federal Housing Finance Agency), announced they would be assessing a 0.5% fee on all refinances that were delivered to Fannie Mae and Freddie Mac after September 1st. This meant any conventional refinance that closed basically after August 20th was subject to the fee. A typical refinance takes anywhere from 30-45 days. Since clients currently in process had already locked their rate, lenders would have covered that fee, however that fee would need to be factored into rates for any clients currently looking to refinance.

As a short term fix, the FHFA just announced the good news that they will be postponing that fee until December 1st. When the fee takes effect in December, it will be imposed on both cash-out and no cash out-out refinances. Any loan with a balance of less than $125,000 will be exempt. This is a small win; however, lenders will still need to factor this fee into their refinance pricing starting in October.

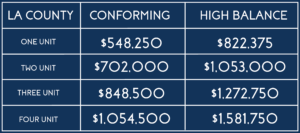

Jumbo Loans

Jumbo loans have been hard to obtain since the beginning of the Covid-19 pandemic. Jumbo loans are usually any loan over $765,600. These are not government backed loans, so they hold a bit more risk to lenders. At the end of March, many Jumbo programs were suspended and the few that were left had rates in the 4-5% range. This was seen by all lenders across the industry. Recently, we have rolled out our Jumbo Loans again and even have new Jumbo products. Depending on your scenario, current Jumbo rates can range from 3-3.875%. Keep in mind, Jumbo loans have more restrictions when it comes to qualifying for these loans.

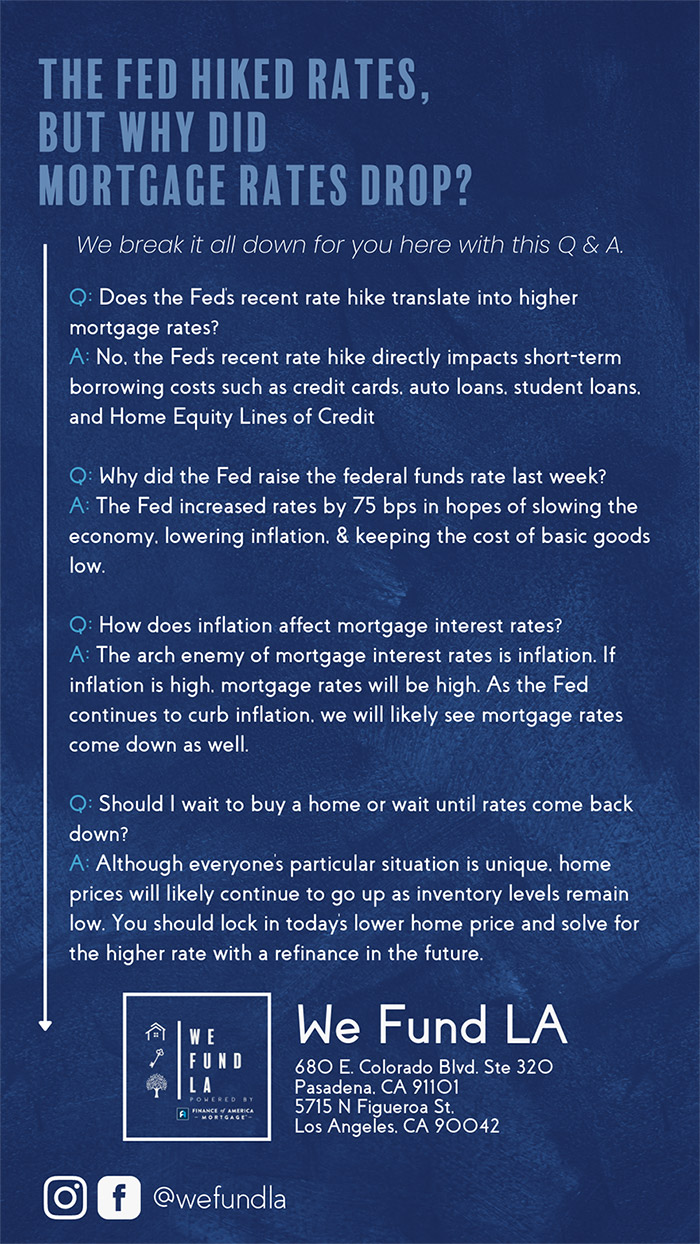

Economic Update

Fed Chairman Jerome Powell spoke this week at the virtual Jackson Hole symposium. Powell mentioned that the Fed is willing to allow inflation to run higher than the normal in order to reach their average goal of 2% to support the labor market and the economy. He also said the Fed would be less inclined to hike rates when unemployment falls.

Multiple housing reports such as the FHFA’s House Price Index as well as the Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, show that nationally appreciation and home prices are up. Affordability is still good due to low rates and homes are appreciating at a good pace, but not too fast.

The We Fund LA Team