Economic Update

The economy is suddenly heading for a speedy recovery, as millions of Americans head back to work. Jerome Powel, chair of the Federal reserve elaborated on the current state of the market in a recent interview, saying “What we’re seeing now is really an economy that seems to be at an inflection point. And that’s because of widespread vaccination and strong fiscal support, strong monetary policy support. We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation coming in much more quickly.”

So what does this mean for interest rates and inflation? Powell went on to say that the Fed has updated their understanding of the economy and is now better equipped to regulate it. He says “The economy has changed. And what we saw in the last couple of cycles is that inflation never really moved up as unemployment went down. We had 3.5% unemployment, which is a 50-year low for much of the last two years before the pandemic. And inflation didn’t really react much. That means that we can afford to wait to see actual inflation appear before we raise interest rates. Now, we don’t want inflation to go up materially above 2% and go back to, you know, the bad, old inflation days.” Powell mentioned that in 1980 the Fed’s benchmark interest rate was 20% and people took mortgages out at that rate.

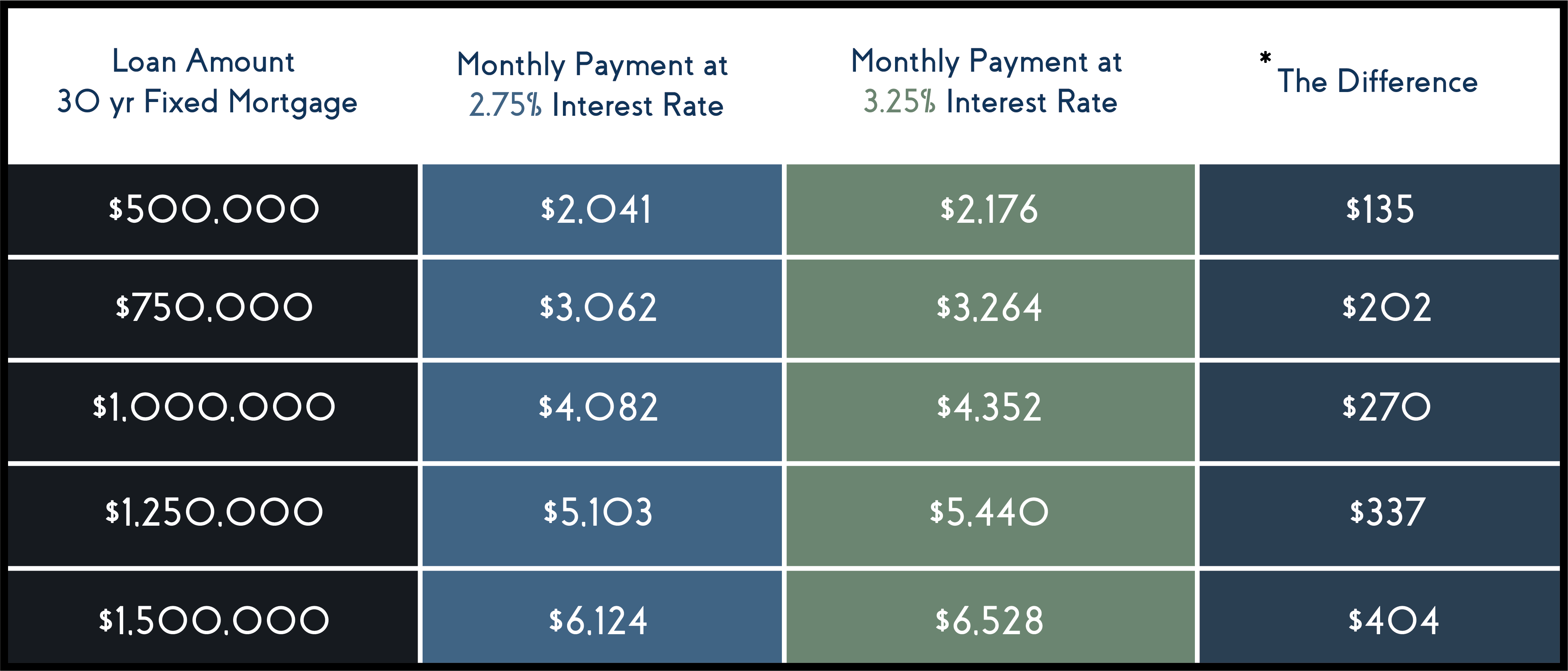

This really puts into perspective how low current interest rates are, even with the recent upward pressure on interest rates, the graph below Illustrates how little it impacts the borrower.

* payments reflected above are principal & interest payment and do not include property taxes & insurance.