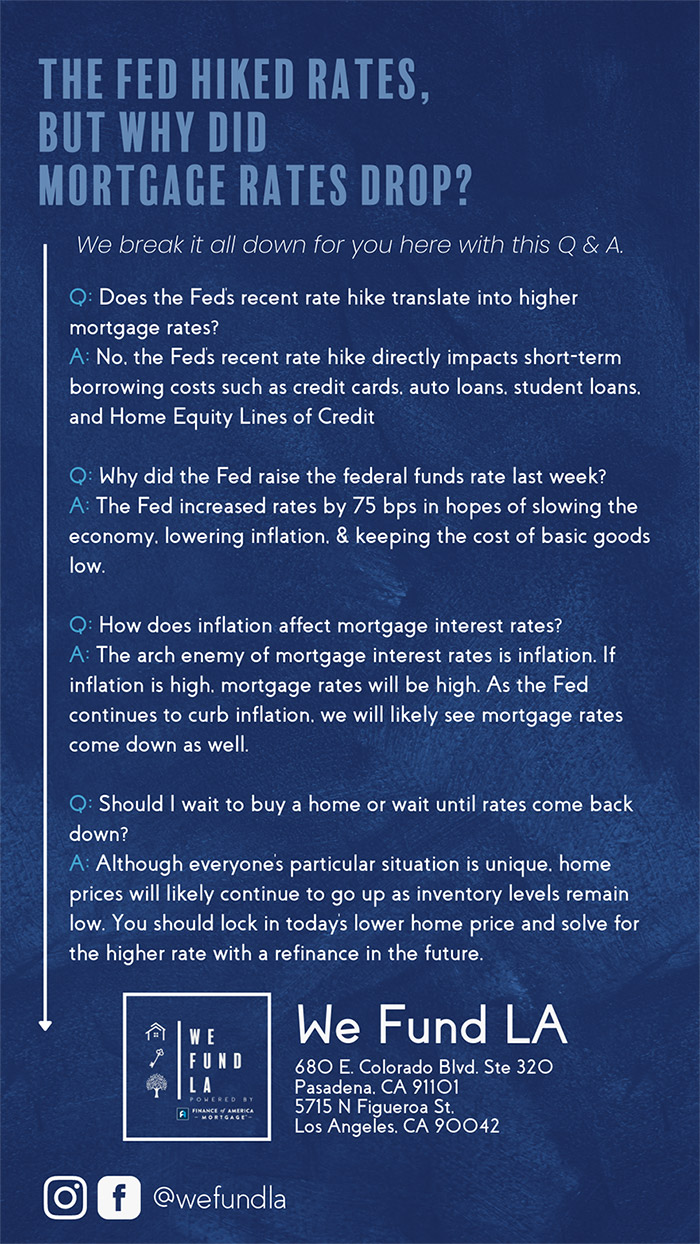

Everyone is asking, what is going on with interest rates?

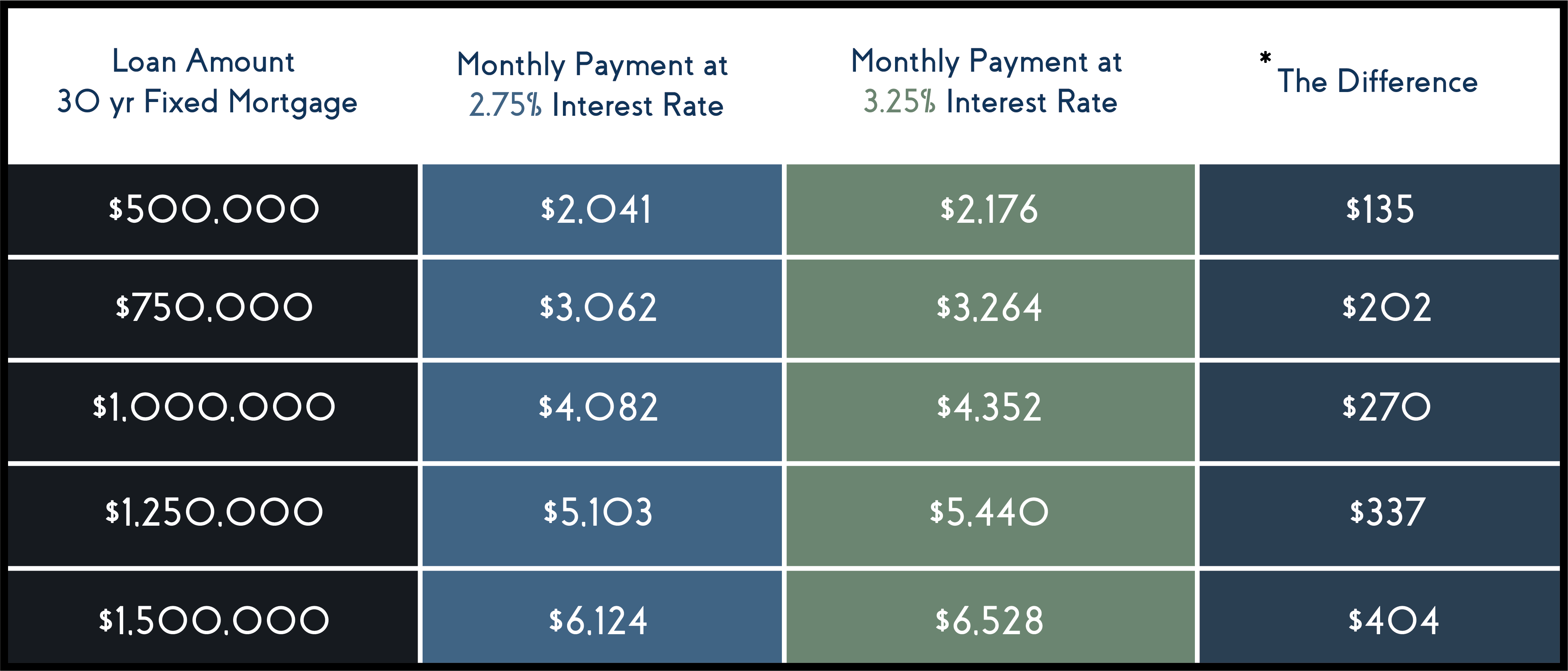

The prolonged low mortgage rates have offered some financial relief to homebuyers in the hot housing market during the past year, but that trend is not expected to last long into 2022.

In fact, mortgage interest rates have steadily increased from 2.67% in January 2021 to 3.12% by mid-December. Still, they’ve remained in the historically low 3% range throughout the year, according to data from Freddie Mac.

However, mortgage rates are facing serious challenges as we head into the new year, namely skyward inflation, and the Federal Reserve’s plans to increase the federal funds rate and reduce their purchasing of mortgage backed securities—all of which could drive up mortgage rates. The consumer price index (CPI), which indicates the rate of inflation by looking at the cost of consumer goods and services, rose 6.8% for the previous 12-months ending in November, the highest jump for a one-year period since June 1982.

How will this effect the housing market?

This used to be a pretty easy question to answer: when interest rates go up, it costs more to purchase a home, and demand diminishes. Price appreciation slows, and homes take longer to sell and more expensive money also meant fewer investors holding homes so inventory would climb as well.

This year, the numbers aren’t as clear cut. The market has been so hot, many worry that rising rates will finally be the straw that breaks the housing markets back. Is there a housing bubble that is about to burst? Sure doesn’t look like it. Even as rates have begun to climb, homes are still flying off the market nearly three times faster pre-pandemic levels. The price of new listings continues to rise, which is a very bullish indicator for sales prices in the coming months. People have been lined up to buy homes for so long that increased costs haven’t deterred any demand.