Everyone is asking, what is going on with interest rates? The prolonged low mortgage rates have offered some financial relief to homebuyers in the hot housing market during the past year, but that trend is not expected to last long into 2022. In fact, mortgage interest rates have steadily increased from 2.67% in January 2021 to 3.12% by mid-December. Still, they’ve remained in the historically low 3% range throughout the year, according to data from Freddie Mac. However, mortgage rates are facing serious challenges as we head into the new year, namely skyward inflation, and the Federal Reserve’s plans to […]

Economic Update The economy is suddenly heading for a speedy recovery, as millions of Americans head back to work. Jerome Powel, chair of the Federal reserve elaborated on the current state of the market in a recent interview, saying “What we’re seeing now is really an economy that seems to be at an inflection point. And that’s because of widespread vaccination and strong fiscal support, strong monetary policy support. We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation coming in much more quickly.” So what does this mean for […]

Volatile Interest Rates Rates in the last week and a half have shifted drastically and continued to do so this week. Below is the 30yr Bond Chart directly from the market. The lower the blocks go in the chart, the higher the interest rate/pricing will be. The higher the blocks are on the chart, the lower the interest rate/pricing will be. The green blocks reflect positive movement towards the top, for better pricing and the red blocks represent lower movement, for higher interest rate(worse pricing). Now this volatility is expected in a new election year, new stimulus bill conversation, vaccine […]

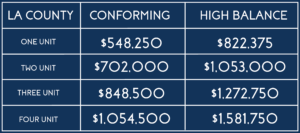

Did You Miss the Refi Boat? In case you were wondering if you missed the refinance boat, you have not, rates remain near record lows. Refinancing your existing mortgage can accomplish a number of money savings goals. You can reduce your monthly payment, you can shorten the term of your loan, or you can take cash out and utilize some of the equity you’ve built to eliminate high interest debt or finally get that home remodel project done. Call us today for a free mortgage analysis. Jumbo Loans We are happy to announce that we are now a leading lender […]

Interest Rates What impact did the election have on interest rates? Many have been wondering if there would be a significant shift in interest rates due to the election outcome. We now know the election had no significant impact on interest rates. The promising news of an effective vaccine however, could impact rates. News of an effective vaccine allow us to begin thinking about a post covid world and a robust economic recovery. The stock market reaching new record highs is in part a result of the goverments efforts to preserve household incomes. When the governments stimulus efforts seize, we […]

Housing Update Despite the fact that we are in the midst of a global pandemic, home prices continue to rise. There are 3 distinct catalysts driving this growth, fiscal policy, consumer preferences, and monetary policy. In regards to our fiscal policy, typically in a recession, people lose their jobs, incomes drop, and foreclosures and distressed sales drag down home prices. We have not seen this level of devastation as the government has taken measures to preserve household incomes. Foreclosures in the United States, as a share of all mortgages, are at their lowest level since 1984. Our monetary policy has […]

FHFA Refinancing Fee-Delayed Originally on August 12th, the FHFA (Federal Housing Finance Agency), announced they would be assessing a 0.5% fee on all refinances that were delivered to Fannie Mae and Freddie Mac after September 1st. This meant any conventional refinance that closed basically after August 20th was subject to the fee. A typical refinance takes anywhere from 30-45 days. Since clients currently in process had already locked their rate, lenders would have covered that fee, however that fee would need to be factored into rates for any clients currently looking to refinance. As a short term fix, the FHFA […]

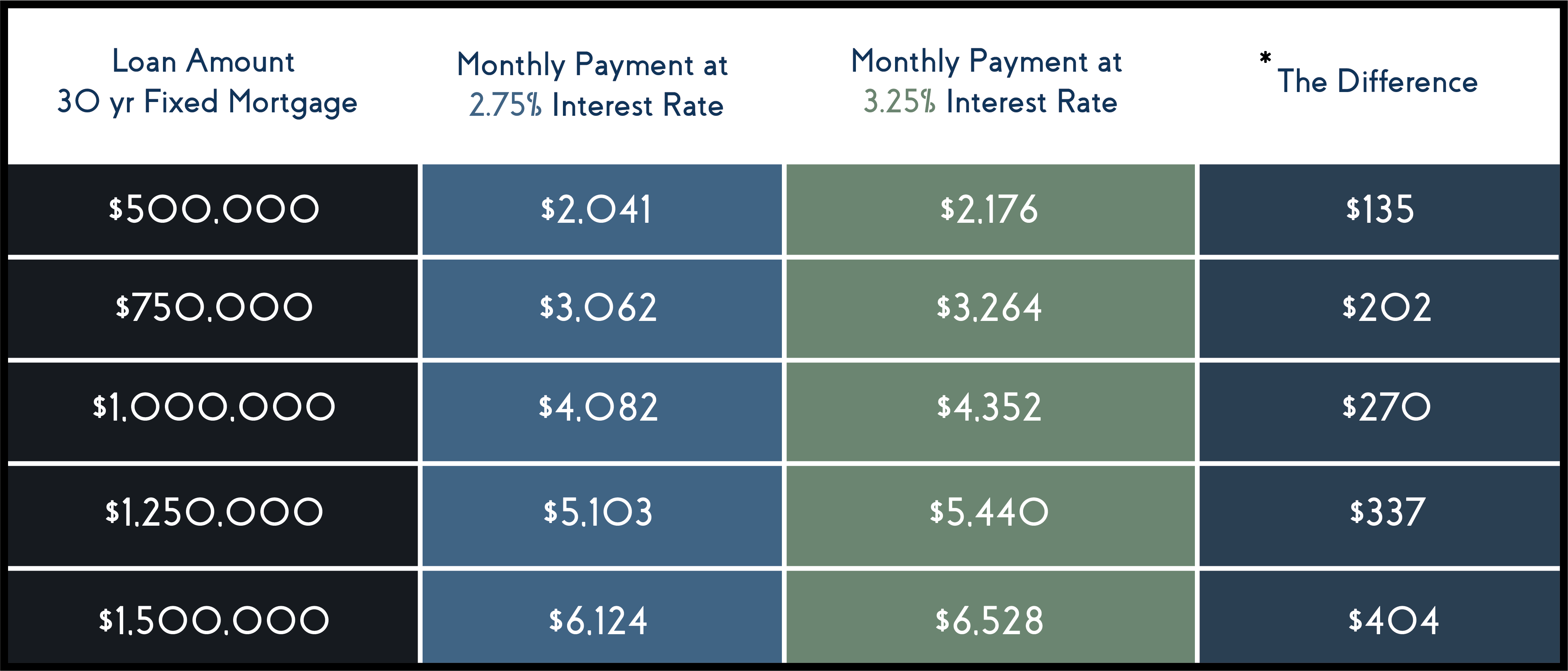

Interest Rate Update Interest rates are hovering near all-time lows. However, you have to be careful with the reports that the media puts out in terms of rates. A couple weeks ago, there was a report that rates had hit an all-time low according to the Freddie Mac’s report. When going to Freddie Mac’s website, you see the rates they use factor in you paying .8% in points. Points are additional closing costs on top of the standard lender, escrow, and title closing costs. The .8% in points on a $500,000 loan amount is an additional $4,000. Also keep in […]

Will Rates Get Lower? The current rates are at historic lows, even after the Great Recession of 2008. Rates have remained steady and some have asked why they have not gotten lower. There are two catalysts playing an important role that have been ripple effects caused by the Pandemic: 1.) Banks are experiencing capacity issues due to high refinance volume as a result of the historically low rates. Early COVID-19 talk started to lower rates and refinance volume increased drastically causing some banks to reach maximum capacity on loan volume. 2.) Some homeowners have been affected by increased unemployment that […]

Mortgage Update Due to the Covid-19 pandemic, we have seen many significant changes in the mortgage industry that will have an impact on how you conduct business moving forward. With underwriting guidelines and loan programs changing, we will all be living and operating in a plain vanilla loan world for the foreseeable future. A strong down payment, strong credit scores, documentable income, and strong post-closing liquidity, also known as reserves, will be necessary. We have also seen the collapse of the non-traditional mortgage market, also known as Non-QM loans, that provide programs such as: bank statement loans, asset depletion loans, […]

We truly appreciate the opportunity to work with you on such an important financial transaction in your life and look forward to exceeding your expectations!